This is a sponsored post

Even though April is Financial Literacy Month, financial literacy is a topic that requires ongoing conversations to impart different lessons at each age and stage to teach kids necessary lifelong skills. I remember learning how to write checks and balance a checkbook as part of my financial literacy education as part of the brief introduction in school. The rest of what I know came from my parents and experience as I got older.

It might not be necessary to teach kids how to write paper checks in the age of online banking but they do need to be knowledgeable about fundamentals like budgeting, the best way to save for the future, and understanding why it’s important to save rather than constantly spend.

Even though some schools incorporate financial literacy lessons into classroom curriculum, it typically takes a back seat to teaching the core subjects. The “one and done” lesson approach to financial literacy doesn’t provide the new generation of kids with the level of knowledge they need in order to be successful adults. Since teachers don’t always feel comfortable in teaching financial education lessons, we can suggest quality resources to use in the classroom or take it upon ourselves to help our kids develop good financial literacy skills to help them in the future. But we can’t just assume that everything our kids need to know will be learned at school.

What is Financial Literacy?

The President’s Advisory Council on Financial Capability defines it as “the ability to use knowledge and skills to manage financial resources effectively for a lifetime of financial well-being.”

The Importance of Age Appropriate Financial Literacy Lessons

One of the best ways to teach kids lessons that stick is to find practical ways that meet them where they are. For the youngest kids this means concrete lessons about the value of money and money is needed to buy the things we need and want. Older kids who are getting an allowance or are beginning to earn income from babysitting, pet sitting, and after school jobs would benefit from knowing why it’s important to save a percentage of the money they have. College kids need to know the drawbacks of credit cards as offers for free items might tempt them into signing up.

The Consumer Financial Protection’s Bureau’s Money as You Grow provides a overview of the kinds of conversation starters that we can begin having with our kids in their early childhood, middle childhood, and teen and young adult years. I also like The President’s Advisory Council on Financial Capability’s 20 Things Kids Need to Know to Live Financially Smart Lives that provides a breakdown of lessons kids need at every age and stage.

3-5 years should know the following as beginning financial literacy lessons:

- You need money to buy things

- You earn money by working

- You may have to wait before you can buy something you want

- There is a difference between things you want and need

6-10 year olds are capable of having a conversation about the following financial literacy topics:

- You need to make a choice about how to spend your money

- It’s good to shop around and compare prices before you buy

- It can be dangerous to share information online

- Putting your money in a savings account will protect it and pay you interest

11-13 years can better understand more complex issues regarding finances. Some topics to discuss include:

- You should save at least a dime for every dollar you receive

- Entering a credit card number online is risky because someone could steal your information

- The earlier you start to save, the faster you’ll benefit from compound interest, which means your money earns interest on your interest

- A credit card is a type of loan: if you don’t pay your bill in full every month, you’ll be charged interest and owe more than you originally spent

14-18 years have disposable income and are thinking ahead to college years. Here’s what they should know:

- It’s important to know what a college will cost before you choose it

- You should avoid using credit cards to buy things you can’t afford to pay for with cash

- Your first paycheck may seem smaller than expected since money is taken out for taxes

- A great place to save and invest money you earn is in a Roth IRA

18+ years and older who are living independently at college need to know to plan for their future. Here are some topics to discuss with them:

- You should use a credit card only if you can pay off the money owed in full

- You need health insurance

- Putting your eggs in one basket can be a risky way to invest; consider a diverse mix of stocks, bonds, and cash

- Always consider two factors before investing: the risks and the annual expenses

How to Help Your Kids Learn Financial Literacy

If teaching financial literacy seems overwhelming or you don’t feel qualified to serve as an example due to your own personal finances, there are many resources that can help. Along with their chart of financial literacy milestones for each age and stage of life, Money as You Grow features activities and conversation starters for families. Another helpful resource is the Earn Your Future Digital Lab.

Earn Your Future Digital Lab: Free Financial Literacy Resource for Parents & Teachers

If you’re looking for more than conversation starters and more robust activities, the Earn Your Future Digital Lab is a new interactive curricula designed to empower young minds with financial and economic knowledge. Presented by the PwC Charitable Foundation, which supports education and financial literacy, Earn Your Future Digital Lab is a series of online learning modules that teach foundational concepts for kids in grades 3-12 through real-world scenarios.

By engaging with financial literacy concepts through innovative self-paced modules featuring custom videos, animations, and interactive activities, kids learn about essential personal finance topics through adults who are empowered through the provided materials to deliver the lessons confidently.

I appreciate the flexibility of the materials that can be used to teach an entire class, small home schooling groups, or individuals and it’s impactful, relatable, and aligned with Council for Economic Education standards so kids are learning personal finance fundamentals like earning income, using credit, financial investing, buying goods and services, saving, and protecting and insuring.

Getting Started with Earn Your Digital Future Lab

Parents, teachers, and guardians can access the Digital Lab through this URL: https://app.pwcfdnearnyourfuture.org/

Sign in with an existing account or create a new one. It’s quick and easy to create a new account!

After logging in, you will arrive at a Dashboard page. Parents can skip the classroom sign up and go to the left-hand menu to click “Launch Earn Your Future Digital Lab” to begin

You will arrive at the logged-in teaching materials page that looks like this:

There are 3 different levels:

- Level 1 Beginner (grades 3-5) — Coming this fall

- Level 2 Intermediate (grades 6-8)— The 7 different modules for middle school classrooms and families are designed for kids to interact and learn in order to explore the world of personal finance. Working through the seven modules helps students plan for the future and make smart decisions about money.

- Level 3 Advanced (grades 9-12)— 8 different modules for middle school classrooms and families help prepare high school students for life after graduation. Topics include careers, income, saving, credit, budgeting, home buying, risk, insurance, the stock market, and more. I love how these more advanced topics fit the needs of older learners at a time in their lives when they’re important to know about.

Example of an Earn Your Digital Future Financial Literacy Lessons

I took a look at Earn Your Future Digital Lab’s Level 2 Intermediate lessons designed for middle schoolers and Module 3: Can I Afford a Phone? immediately caught my eye since the topic of phones, data plan overages, and excessive texts has been a hot topic of conversation among fellow parents of newly minted middle schoolers. The module asks “If you were challenged to save up for something you really wanted, where would you begin”

The module begins with a video that introduces middle schoolers high school student named Jonas who drops hints to his mom about his desire for the latest and greatest smartphone via a computer chat because he doesn’t have a smartphone. He thinks he can just have his parents add a line to their phone plan but when his mom asks him a series of questions texts, overages, what phone is the best, Jonas concludes he needs to do some research about phones, plans, and how to pay for the monthly bill.

Even though he currently has $85 in savings, he’ll need a way to continue earning money to pay his phone bill. His dog walking job will help but after realizing he doesn’t know the answer to many of his mom’s questions about his desire for a phone, he decides to do some additional research.

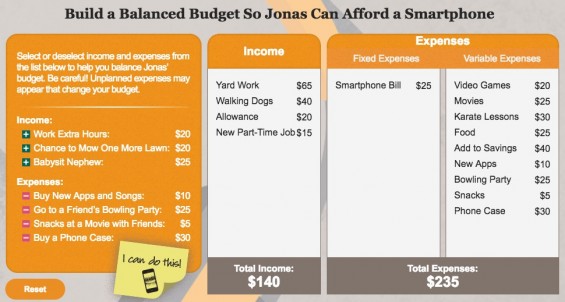

The second part of the module is a pre-test to gauge knowledge about some of the topics covered in the video. This particular module asked questions about budget, income, and expenses before asking kids to consider what they’ve learned to answer two questions. The module continues with a video that begins with a girl shopping for a tablet and Budget, an animated character who helps her determine her income and expenses to figure out if she can afford the tablet she wants. It serves as an introduction to the interactive budgeting that kids do in the next part of the module to help Jonas figure out how he is going to be able to afford a smartphone.

The module presents you with this screen:

By applying knowledge about fixed and variable expenses and income, kids work through adjusting Jonas’ variable expenses to help him afford a smartphone. Here’s how I balanced Jonas’ monthly budget:

The main goal of Module 3 is to get students to understand income, expenses (fixed and variable), the need for a balanced budget, saving money for the unexpected, and understanding what you can truly afford.

Through interactive lessons like building a balanced budget for Jonas by taking a look at his income, fixed expenses, and variable expenses, kids learn that budgeting isn’t a one time thing and rather it’s something that need to be revisited and adjusted based on income and expenses.

Summary

In order to develop financial literacy, parents need to build upon a child’s knowledge about money and how to properly manage it in age appropriate ways by using real world examples. I love the modules in Earn Your Future Digital Lab because the examples are ones that are relevant to today’s kids and are fun to complete in order to learn important lessons in financial literacy.

Kids can move through each module at their own pace, pausing, going back, or even replaying the entire thing. It’s also helpful that Earn Your Digital Future provides tools like a glossary, basic calculator, and mortgage calculator that kids can access while working on the modules to help them with tasks as they learn. Teachers can access an educators’ guide.

Parents and teachers will appreciate Earn Your Digital Future because the content is free. Teachers and parents can quickly create free accounts to access interactive lessons.

This is a sponsored post in partnership with PwCCharitable Foundation, but all opinions are my own.

My 7 year old has been asking for a bank account to save up for more football cards!! I need to get him to the bank to sign up!

My daughter is a preteen and she just wants to shop all the time. I am really trying to teach her the value of shopping when things are on sale!

We are only in the 3-5 range, but these are great tips!

I always say balancing a checkbook was one of the most useful things I ever learned in school. It’s SO important to get this info at a young age.

i love this article and had to comment again. i love that this article is teaching about money and how to be finacial stable.